When her paycheck failed to arrive, Lakisha Murphy went into crisis containment. Murphy, who has served nearly 20 years at the Internal Revenue Service and now leads NTEU Chapter 26 in Georgia, opened her banking app and began listing every automatic deduction scheduled for the week, including the mortgage and utilities, then she paused.

“I was in planning mode,” she said. “I thought, ‘Which companies do I need to call? How do I undo things that will trigger NSF fees or late-payments?’ I don’t want those extra costs. But I’m upset that I’m doing this through no fault of my own.”

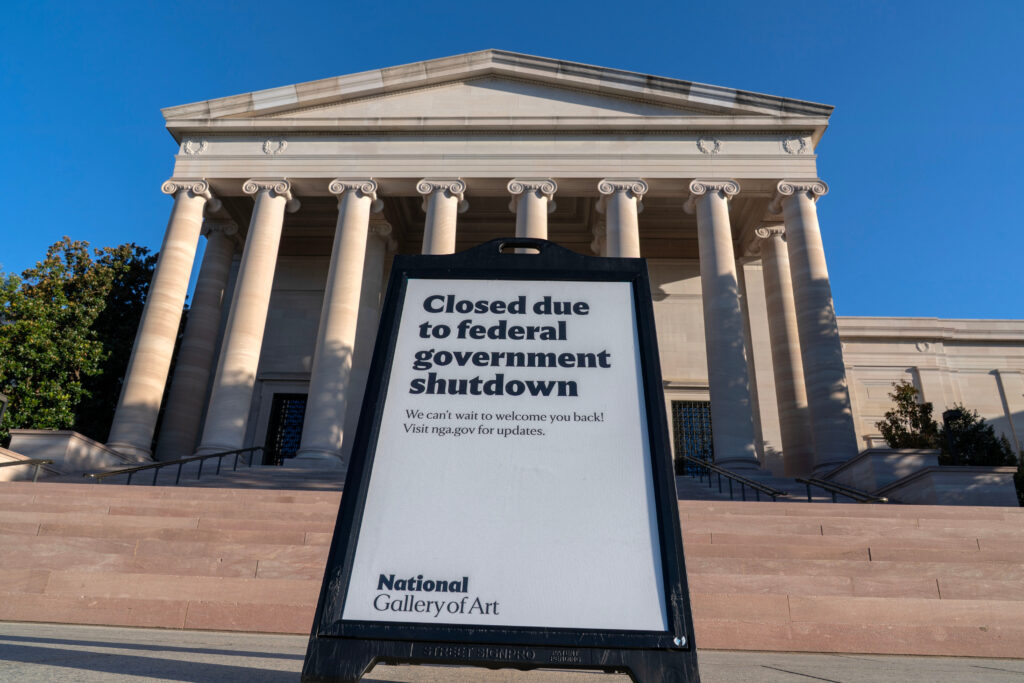

Murphy’s moment reflects that of thousands of federal employees nationwide in the fourth week of a shutdown that began Oct. 1. Nineteen days later, the U.S. Senate rejected a Republican-led continuing resolution for the 11th time, leaving nearly 2 million federal workers without pay and about 750,000 furloughed. For many workers, the shutdown is no longer an abstraction in Washington, but a daily ledger of bills and due dates.

“Parents are telling me they’re worried about having to pay for childcare even though they’re home, just to hold their spot for when we go back,” Murphy told Black News & Views. “We’re not getting paid, but we still have to fulfill obligations to make employment possible next time. Where are those funds supposed to come from? Most of us live paycheck to paycheck.”

One union member, she added, has been denied any grace on upcoming rent and now faces eviction, a scenario she believes is becoming common nationwide as the days without pay stretch on.

“Those who downplay the impact simply because we may be repaid at the end of all this are missing the fact that people could be evicted, have cars repossessed, will struggle to feed their families and may face utilities being turned off before we receive our salary,” Murphy said. “There’s no end in sight for this shut down and so much could go wrong before our congressional leaders reach an agreement. Eventually receiving pay just to be eaten up by reconnection fees, late fees, and penalties of higher interest rates because of late payments is unfair. Again, we did not do this.”

A patchwork safety net emerges

As paychecks stop, a network of support has begun to form. In New York City, the Emma L. Bowen Community Service Center in Harlem announced earlier this month that it would open its food pantry to furloughed federal employees and add a Friday distribution day to its standard Tuesday–Thursday schedule. The pantry typically distributes more than 89,000 food packages annually to individuals and families in need. In response to the shutdown, federal workers can access the pantry during regular hours — Tuesday through Thursday, 11 a.m. to 2 p.m. — and on the added Friday distribution day.

“The Bowen Center has always stood with our community in times of crisis, and this moment is no different,” Patricia C. Jordan, the center’s board chair, told Black News & Views. “With the government shutdown threatening the livelihoods of thousands of New Yorkers, including dedicated federal employees, it is our responsibility to step forward.”

Across the banking sector, there has also been support. According to the American Bankers Association, many banks and credit unions serving federal workers have introduced short-term programs to support employees affected by the shutdown.

“Various banks that service federal employees like Navy Federal Credit Union, USAA and others offer different programs for impacted workers,” said Javier Palomarez, founder and CEO of the United States Hispanic Business Council.

“Options can range from zero-interest loans and mortgage deferments to special payment plans for credit cards. Generally, these programs require verification of identity and employment, such as pay stubs or government ID,” he said.

For federal workers, the emotional toll is rising alongside the financial strain.

“We’ve felt harassed and devalued most of this year,” she said. “Going into this shutdown only worsened things. Anxiety is high. Frustration is high.”

Health professionals agree that stressful situations like layoffs can negatively impact mental wellness.

“When the world feels unstable beneath you, your emotional support system is what matters most,” said Yovanna Madhère, a licensed social worker in Atlanta and founder of HealthLoveSoul, a mental health support effort. Each federal agency has an Employee Assistance Program that can provide short-term counseling and referrals for stress, anxiety and major life changes at no cost, she said.

Equity and workforce implications

Civil rights organizations have worked to ensure affected workers know where to turn for help.

“It’s the role of community organizations to raise awareness, educate and guide their constituents through the various programs available to them,” Palomarez said.

On Oct. 15, the National Urban League’s Fair Budget Coalition joined with federal employees virtually to demand an end to what they called the “unnecessary shutdown crisis.” Marc H. Morial, the organization’s president and CEO, led a coalition that included union leaders and civil rights advocates in calling for Congress to safeguard health care and ensure that critical federal funding reaches the communities that need it most.

“We are here today to insist that our elected leaders end this shutdown, safeguard health care, and ensure that critical federal funding is used responsibly and reaches the communities that need it most,” Morial said. “This is not an either-or choice; it is an urgent imperative.”

Labor unions have also mobilized.

The American Federation of Government Employees and the American Federation of State, County and Municipal Employees filed a lawsuit in U.S. District Court for the Northern District of California on Sept. 30 to block the Trump administration from mass firings during the shutdown, arguing the terminations violate federal labor law.

How the “F” word—furlough—is playing out

The shutdown stems from a bitter dispute over extending enhanced ACA subsidies set to expire at year’s end. Democrats are demanding that any short-term spending bill include a fix for the expiring tax credits, which cover more than 20 million Americans. Republicans passed a continuing resolution in the U.S. House to fund the government through Nov. 21 without addressing the healthcare subsidies, arguing that Democrats are being hypocritical for blocking the measure and demanding concessions.

Constituent help and the road ahead

Elected officials are working to connect constituents with available resources. U.S. Rep. Alma Adams, a North Carolina Democrat, urged anyone impacted by what she called the “Republican government shutdown” to contact her offices for help.

“Whether you’re a mother struggling to get WIC for your family, a senior who needs help with Social Security, a veteran unable to access your VA benefits, a federal worker who has been furloughed or fired, or anyone else impacted by the shutdown, I am here to help,” Adams said.

Federal employees who are furloughed are guaranteed to receive retroactive pay once the government reopens under the Government Employee Fair Treatment Act, which was passed on Jan. 16, 2019. But this is cold comfort to those already absorbing the costs.

“We have received notices from a few banking institutions and credit unions offering zero-interest loans up to the amount of our regular direct deposits from our salaries,” Murphy said. “ I have received notices from one of my banks, inviting me to call to discuss arrangements should I need it.”

Murphy said many of her members appreciate the help but are frustrated that it is needed at all.

“We are grateful for the willingness to work with us,” she said, “but this is help we should not have to ask for. We should not be here. We should be working and receiving our pay on time.” Members are trying to stay hopeful, she added, but the strain is real.

A first critical deadline looms Nov. 1, when ACA policyholders can begin signing up for 2026 coverage. Until then, federal workers will continue relying on a patchwork of support from community organizations and elected officials — a safety net that may be tested further if the impasse continues.

In Georgia, Murphy keeps her list within reach. Some boxes may be checked later; the deadlines will not wait. “Please put yourself in our shoes,” she said. “If your household is not negatively affected, count your blessings. But I guarantee there’s someone in your neighborhood, someone in your building, whose paycheck stopped. Who is calculating because they have to.”