(Bloomberg) —

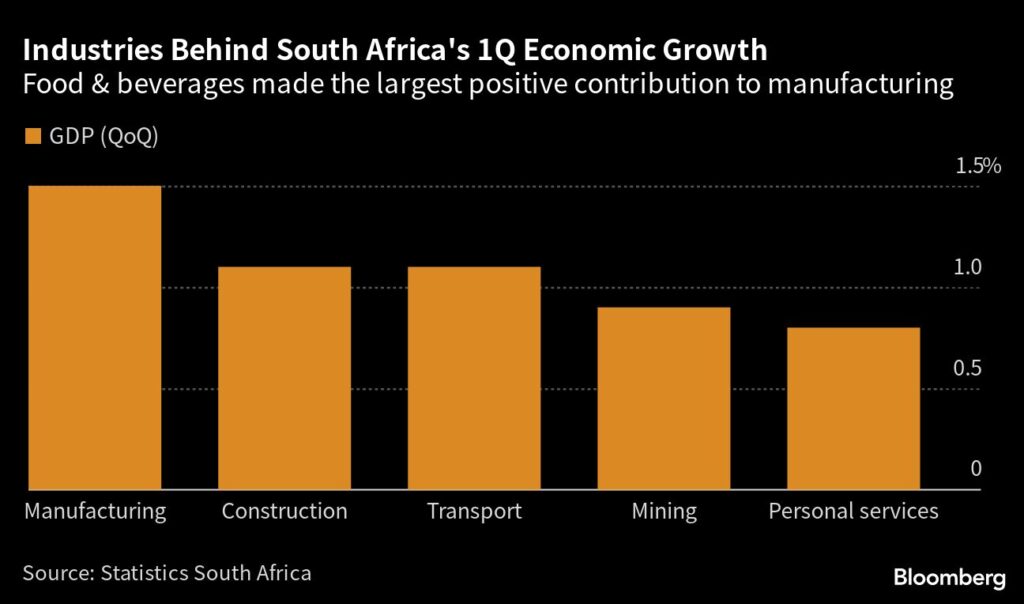

South Africa’s economy escaped recession in the first quarter and is once again bigger than before the coronavirus pandemic hit, as most sectors grew.

Gross domestic product expanded 0.4% in the three months through March, after contracting a revised 1.1% in the previous quarter, Statistics South Africa said in a report released in the capital, Pretoria, on Tuesday. That matched the central bank’s forecast and the median estimate of 16 economists in a Bloomberg survey. The economy grew 0.2% from a year earlier.

The rand extended gains, appreciating 0.2% to 19.23 per dollar by 1:45 p.m. in Johannesburg, while the yield on the benchmark 10-year government bond fell 11 basis points to 12.12%. South Africa’s main stock index declined 0.3%.

At an annualized 4.61 trillion rand ($240 billion) in the first quarter, GDP is 18.5 billion rand bigger than it was in the last three months of 2019, before the pandemic struck, but 34 billion rand smaller than between July and September 2022.

Mining and manufacturing, which make up more than a fifth of GDP, rebounded in the quarter, showing a bit of resilience, Statistician General Risenga Maluleke said.

The economy’s lackluster performance was largely due to record power cuts imposed by state power utility Eskom Holdings SOC Ltd., which is unable to meet demand from its old and poorly maintained plants.

The outlook for Africa’s most-industrialized economy remains bleak.

Calib Cassim, Eskom’s acting chief executive officer, last month warned that the country faces a difficult winter and in a worst-case scenario 8,000 megawatts of electricity may have to be cut from the grid. That would translate into outages for half of every day. Last week, Finance Minister Enoch Godongwana said the daily outages constituted a “major problem” that will constrain corporate tax revenue.

Tiger Brands Ltd., The Foschini Group Ltd. and Anglo American Platinum Ltd. are among those whose profits have been eroded by the blackouts. To mitigate the impact, many firms have invested in diesel-powered generators. The central bank estimates that the power they generate costs 133% more than energy from the municipal grid.

| Read more on the impact of power cuts on companies’ profits: |

|---|

| Amplats Cuts Payout as South African Outages Crimp Profit Pick n Pay Misses Dividend Estimates as Power Costs IncreaseTiger Brands Falls Most Since 1998 as Power Cuts Hit Profit |

The power cuts, slow structural reforms, political uncertainty and high levels of crime continued to weigh on fixed-investment spending in the quarter. Gross fixed capital formation rose 1.4% from the previous quarter.

Household spending, which comprises about two-thirds of GDP, rose 0.4% in the first quarter. It’s likely to face further pressure from persistent inflation and high interest rates that are at a level last seen during the global financial crisis 14 years ago.

(Updates with market reaction in third paragraph)

–With assistance from Simbarashe Gumbo.

© 2023 Bloomberg L.P.